UPI Transaction Limit Per Day set by Indian Banks: UPI stands for Unified Payment Interface. The National Payment Corporation of India develops this interface. The Reserve Bank of India regulates it. UPI has become an essential part of our lives. It has become one of the easiest modes of online payment in India. It enables the user to instantly transfer funds to the merchants through their mobile apps. UPI payment option gives the user flexibility, security, and easy access to funds for various online purchases or services.

Since RBI is the governing body in India for all financial transactions, so do UPI has to abide by its rules and regulations. On January 1, 2024, a new change came into effect that is about transaction or surcharge fees.

Understanding the Transfer Limit of UPI

As per NCPI, the transaction limit is Rs.1 lakh per day. However, if payment is to be made for educational institutions and healthcare, the limit is Rs.5 lakhs. From bank to bank, the maximum limit for daily transfer through UPI varies from Rs. 25000/- to Rs. 1 lakh. Few banks have set up their upper limit as per week or month instead of a day.

NCPI sets an upper limit for the maximum number of UPI transactions per day. As per new guidelines, per day, 20 UPI transactions are allowed; after that user has to wait for 24 hours to start the transaction. These limits may vary from bank to bank. Only 10 transitions are allowed for third-party UPI apps.

Also, a 30% volume cap has been put on all UPI apps by NCPI. This is done to ensure that UPI apps do not form a trust in the UPI market. UPI payments through a digital wallet such as Phonepe, Paytm, Sodexo voucher, Freecharge, and Amazon Pay have to pay an intercharge fee of up to 1.1% for certain merchant payments above Rs 2000. The bank charges this particular fee for the payment service. The merchant who has received the payment has to pay this. However, normal customers do not have to pay transaction charges.

Interchange Fee or Surcharge Fee on UPI Payment

Interchange fees are the fees imposed on the merchant when the customer processes aUPI transaction through their prepaid payment instrument. Understanding the concept of inter businesses and individuals to associate with using UPI transactions. Here is the list of a few categories:

- Post office, telecom, utilities, agriculture, and education: 0.7%

- Fuel: 0.5%

- Supermarket: 0.9%

- Insurance, mutual funds, and railway: 1.1%

Guidelines for UPI Transaction

As per the new guidelines by NCPI, UPI transactions through PPI have to pay the intercharge fee of up to 1.1% of the transaction amount. These charges will be imposed on the UPI transactions made through prepaid instruments like wallets, Amazon Pay, etc. Only for specific merchants like online and large merchants will be charged above Rs.2000/-. It means the charges have to be paid by the merchants, not by the customers or users.

UPI Transactions that are Exempted from Transaction Fee

All UPI transactions are not required to pay the transaction fee. Few of them are exempted from this. Individual transfers, online purchases, and transactions through wallets. Small businesses whose monthly UPI transactions are estimated to be less than or equal to Rs. 50000 are also not eligible to pay inter-charges fees. Transferring money from individual to individual or from indication to small business and also exempted. UPI transactions done between bank accounts do not entail any transaction fee.

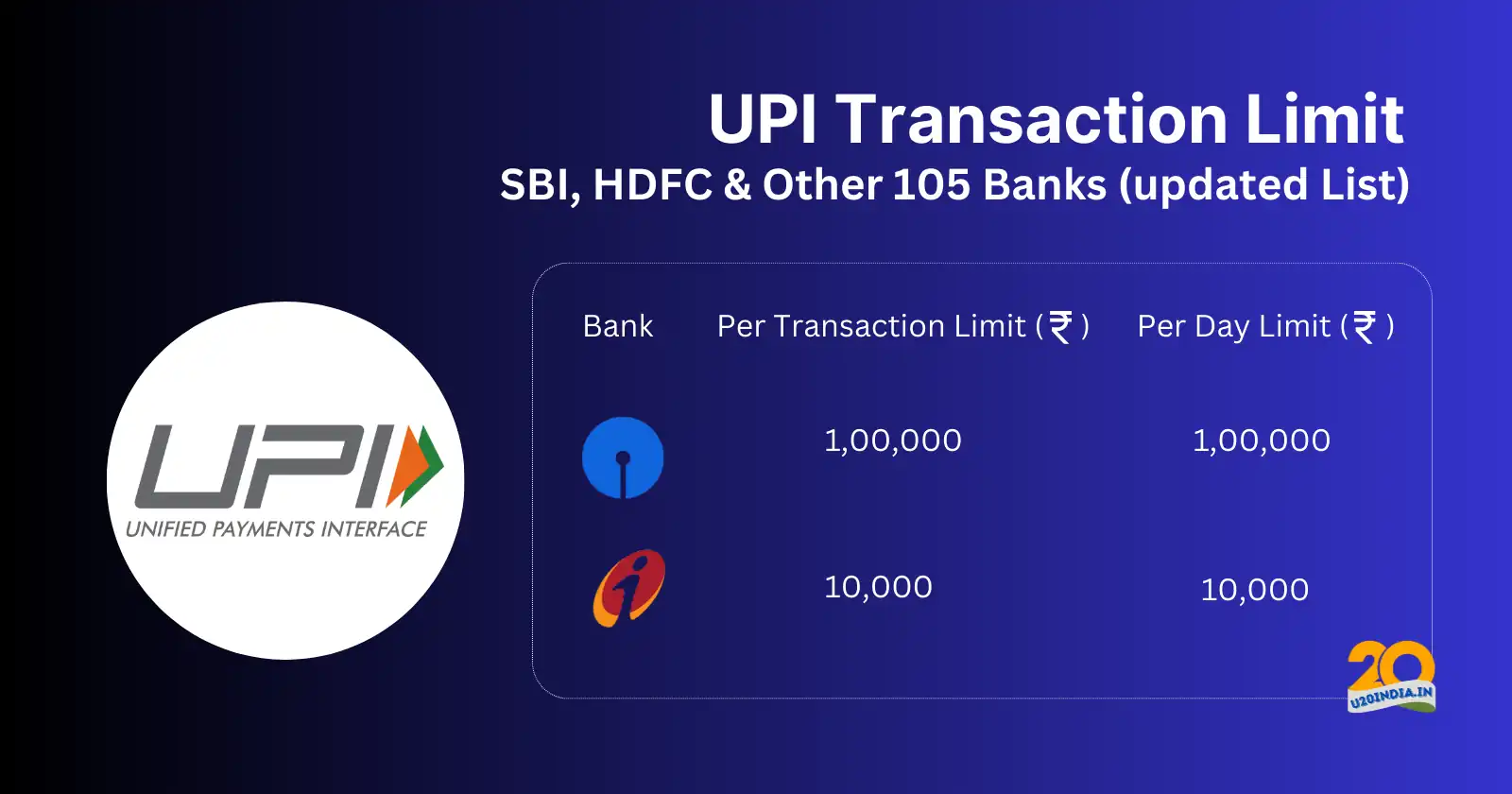

Top Bank with their UPI Transaction Limit

The number of transactions and UPI transfer amount is set by NCPI, which is a maximum of up to 20 transactions or Rs.1,00,000/- in a day. However, various bank have their limits. Here is the list of some Indian banks with the details of their UPI day limit and transaction amount limit.:

| BANK | UPI DAY LIMIT | UPI TRANSACTION AMOUNT LIMIT |

| SBI | Rs.1,00,000/- | Rs.1,00,000/- |

| ICICI | Rs.1,00,000/- | Rs.1,00,000/- |

| HDFC | Rs.1,00,000/- | Rs.1,00,000/-(Rs.5000/- For new customers) |

| AXIS BANK | Rs.1,00,000/- | Rs.1,00,000/- |

| PNB | Rs.50,000/- | Rs.25,000/- |

| BANK OF INDIA | Rs.1,00,000/- | Rs.10,000/- |

| IDBI BANK | Rs.1,00,000/- | Rs.1,00,000/- |

Most of the banks are offering a good limit for UPI transactions. However, these limits may differ based on the type of UPI transaction. It is important to check with the branch about specific UPI transfers before making the transaction.

Points to Know as a UPI User

There are lots of benefits to UPI transactions. However, there are a few points that, as a user, we need to remember while using UPI:

- Inactive UPI ID: As per NCP guidelines, the bank has to close or deactivate all the UPI IDs which is linked with dormant accounts.

- Transaction limit: The transaction limit varies from bank to bank. In December, the RBI Governor announced to increase in the UPI limit from Rs.1 lakh to Rs. 5 lakh. It is applicable to healthcare and educational institutions.

- Cash withdrawal via QR code: India’s first UPI-ATM is a joint project of NCPI and Hitachi Payment Services. This facilitates the user to withdraw cash by scanning the QR code.

- 4-hour window: RBI has proposed a 4-hour time limit for the new user who is initiating their first transaction over Rs.2000/-. It allows users to reverse the transaction or modify it within that time limit. It is an extra layer of safety and control while doing online transactions.

Conclusion

In today’s digital world, where transactions are happening within a minute through Internet banking, UPI payments have given a new way to handle digital payments. To encourage people to use more digital transactions, NCPI has introduced UPI payments. It works under the rules and regulations imposed by the RBI. UPI has made common people’s lives easier like traveling without cash or a card, payments made within minutes, and getting a reward for every transaction.

There is an extra layer of protection that ensures the user’s safety and to have control over the transaction which they have made. However, in spite of this protection, users have to do minimum basic checks like account number or phone number and name while transferring the amount. It is the fastest way to make any kind of payment like utility bills, online merchant transactions, transferring to a bank account, and transferring to an individual.