TRACES stands for the TDS Reconciliation Analysis and Correction Enabling System. TRACES is an online platform developed by the Income Tax Department of India to offer various services related to the TDS to the deductor, deductee and tax authorities on one platform. This platform connects all stakeholders involved in the administration and implementation of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS). TDS Traces online platform is mostly used to view and download Tax-related documents like Form 16, Form 16A, Form 26AS and many more.

TDS Traces provides services for the following-

Service for TDS Deductors: People responsible for deducting TDS, can use TDS Traces for-

- File TDS returns (Form 24Q, 26Q, 27Q, etc.).

- Download TDS certificates (Form 16/16A) and Form 26AS.

- Verify and correct TDS statements.

- View challan status and utilisation.

- Submit online requests for TDS-related services.

Services for Deductees: People whose TDS has been deducted, can use TRACES for-

- View and download TDS certificates (Form 16/16A).

- Verify the details of TDS deducted from their income.

- Raise grievances or communicate with the Income Tax Department regarding TDS-related issues.

How To Register On TDS TRACES?

To get access to the TRACES service, you need to register yourself to the portal. Here is step by step for TRACES registration-

- Visit the official TRACES website by clicking on https://contents.tdscpc.gov.in/en/home.html.

- On the homepage, navigate to the “Register as New”. Here you need to select the user type from the Deductor, Tax Payer or PAO.

- If you link on the “Taxpayer”, a form will appear that you need to fill out. Enter the required details like PAN Details, Date of Birth, Email Address, Valid Mobile Number, Name of Taxpayer, Details of TDS deducted/collected, Details of Challan used to deposit tax by the taxpayer, Details of 26QB Statement, etc.

- After carefully filling in all the details, click on “Create Account”

- A confirmation screen will appear that you need to check. If any edit, make it and submit the page.

- After confirmation of data, your TRACES account is created and an activating link and activation code will be sent to the registered email ID or number to use in future.

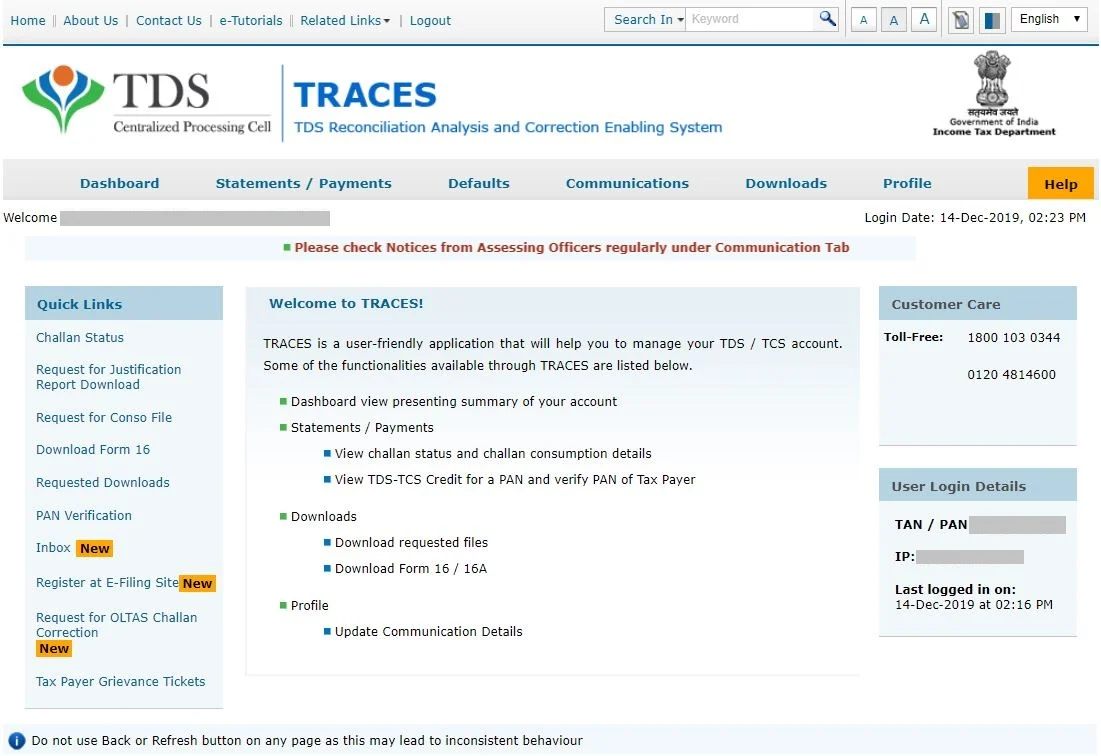

How to Login TDS TRACES?

TRACES (TDS Reconciliation Analysis and Correction Enabling System) provides a user-friendly online portal, where you can log in with your registered credentials. Here is the guide to login to the TRACES website-

- If you are a user of the TRACES website, then visit the official website of the Income Tax Department of India.

- On the home page, navigate to the Login Section.

- Enter your User ID, Password, and TAN (Tax Deduction and Collection Account Number) or PAN (Permanent Account Number) details

- Verify the Captcha code.

- Once the login credentials are verified, you can get access to the TRACES account dashboard.

- On the TRACES dashboard, you can easily use its services like filing TDS returns, downloading TDS certificates, viewing challan details, raising requests, and accessing communication from tax authorities.

- After using the TRACES service, make sure to log out of their TRACES account to ensure the security of their data and prevent unauthorised access.

How To Claim TDS Refund Request On Traces?

For TDS Refund claims, it is important to fill the Form 26QB. Form 26QB is a significant document under the Indian Income Tax Act. If you are a taxpayer and want a TDS refund then you need to request a refund on TRACES. Here is the step to submit the TDS refund request on the TRACES portal-

- Visit the official TDS TRACES website.

- Enter your Login User ID, password, TAN or PAN number.

- After login, on the dashboard, navigate to the Statement/Form section.

- Now navigate to the “Request for Refund” option in the dropdown.

- Depending on the type of TDS transaction for which you are requesting a refund, select the appropriate form or transaction type. For example, if the TDS was deducted under Form 26QB for property transactions, select Form 26QB. Make sure to check all the details are true and correct. You cannot alter it after submitting it.

- On the next webpage, there is a refund checklist. Check all the refund checklists and proceed to the next page.

- Now, you need to select the reason for raising the refund request. Read and check one of them. But click on another, and you can also provide the exact reason for raising the request, within 5000 characters.

- Now add challan and enter challan details like Assessment year, BSR Code, Date of Deposit, Challan Serial number, and Acknowledgement number.

- Check the challan consumption details to check the amount of the maximum refund.

- Click on the checkbox of the “I Agree: button and proceed.

- If you want, you can also add more challan. Macium5 challan you can add. You can also edit or remove the challan here.

- After challan details, proceed.

- Now you have to enter the TAX Payer details like Bank Name, Bank Account Number, IFSC Code, Type of Account and proceed

- On the Verification page, check the Authorised person name and proceed.

- A confirmation page will appear, Review all the details and submit the refund request.

- Now, validate the 26QB refund request by clicking on the Proceed.

- A successful message will appear after completing all the steps.

- Click on ‘Preview and Print Form 26B Acknowledgment’.

- Now you need to submit this form with the required document to the Assessing officer within 14 days for the refund process.

- If you do not submit the form, your request will be rejected.

How To Track TDS Refund Requests on TRACES?

After submitting the Form to the Assessing Officer, you can track the TDS refund request on TRACES.

- Visit TRACES and log in with the credentials.

- Navigate to the Statement/payments and click on the Track Refund Request.

- You can search the request with Refund Request Number Refund Request Date or Challan Details.

- Enter and proceed.

- Your refund status will appear on the screen with reasons like Pending with AO, Pending with TDS CPC, Pending with Refund Banker, and Rejected by AO.