In India, income tax is based on the income tax slabs and rates, which are decided every year. The income tax slabs are different under the old and new tax regimes. For this year, from April, the income tax slab applied for the financial year will be 2024-25, and the assessment year will be 2025-26.

Based on different income tax slab systems, different tax rates are applied to different income ranges. When there is an increase in income, the tax rate also increases. Income tax is handled by the government’s income tax department. With this system, it allows a fair and progressive tax system in the country.

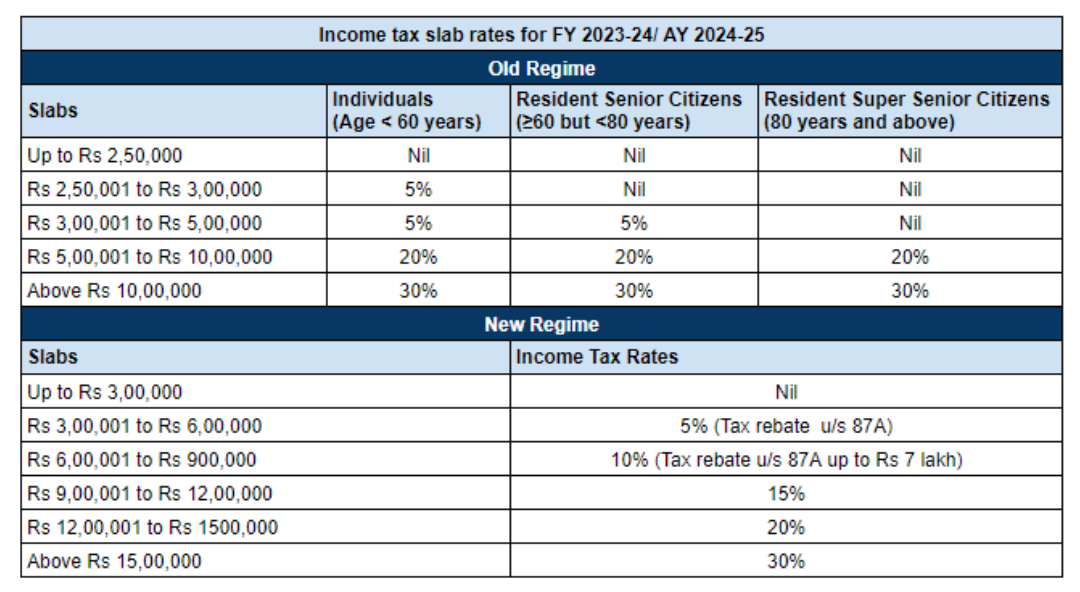

Income Tax Slabs Under New Tax Regime for FY 2023-24, FY 2024-25

The new tax regime introduced in Budget 2023 offers lower tax rates but does not allow most of the deductions and exemptions available under the old tax regime. Here are the income tax slabs for individuals under the new tax regime for FY 2023-24 (AY 2024-25):

- Up to Rs. 3,00,000: NIL

- Rs. 300,001 to Rs. 6,00,000: 5% (Tax Rebate u/s 87A)

- Rs. 6,00,001 to Rs. 900,000: 10% (Tax Rebate u/s 87A up to Rs 7 lakh)

- Rs. 9,00,001 to Rs. 12,00,000: 15%

- Rs. 12,00,001 to Rs. 1500,000: 20%

- Above Rs. 15,00,000: 30%

Income Tax Slabs Under Old Tax Regime

The old tax regime allows taxpayers to claim various deductions and exemptions such as House Rent Allowance (HRA), Leave Travel Allowance (LTA), deductions under Sections 80C, 80D, and more. The old tax regime of the Income Tax is divided into three categories-

- Indian Residents aged < 60 years + All the non-residents

- 60 to 80 years: Resident Senior citizens

- More than 80 years: Resident Super senior citizens

Here are the income tax slabs under the old tax regime of the Income Tax Act, 1961-

For Individuals (Below 60 Years) and HUF

- Up to ₹2.5 lakh: Nil

- ₹2,50,001 to ₹3 lakh: 5%

- ₹3,00,001 to ₹5 lakh: 5%

- ₹5,00,001 to ₹10 lakh: 20%

- Above ₹10 lakh: 30%

For Senior Citizens (60 Years and Above but Below 80 Years)

- Up to ₹2.5 lakh: Nil

- ₹2,50,001 to ₹3 lakh: Nil

- ₹3,00,001 to ₹5 lakh: 5%

- ₹5,00,001 to ₹10 lakh: 20%

- Above ₹10 lakh: 30%

For Super Senior Citizens (80 Years and Above)

- Up to ₹2.5 lakh: Nil

- ₹2,50,001 to ₹3 lakh: Nil

- ₹3,00,001 to ₹5 lakh: Nil

- ₹5,00,001 to ₹10 lakh: 20%

- Above ₹10 lakh: 30%

Why are The Changes Announced in the New Tax Regime in Budget 2023

The latest budget 2023 was announced by Finance Minister Nirmala Sitharaman, he made several changes to the new tax regime for the Financial Year 2023-24 and Assessment Year 2024-25. Here is the key update showing the new tax regime for the Financial Year 2023-24 and Assessment Year 2024-25:

- Increased Basic Exemption: The basic exemption limit has been raised under the new tax regime, which is 3 lakh from 2.5 lakh.

- Revised Tax Slabs: As we already decided, revised tax slabs are follows-

- Up to ₹3 lakh: Nil

- ₹3 lakh to ₹6 lakh: 5%

- ₹6 lakh to ₹9 lakh: 10%

- ₹9 lakh to ₹12 lakh: 15%

- ₹12 lakh to ₹15 lakh: 20%

- Above ₹15 lakh: 30%

- Standard Deduction: A standard deduction is introduced of ₹50,000 for salaried individuals and a deduction for family pension up to ₹15,000 under the new regime.

- Rebate Under Section 87A: The Rebate Under Section 87A is increased under the new tax regime. One who is making income up to ₹7 lakh individually, will not have to pay any income tax.

- Default Tax Regime: The new tax regime is now the default tax regime. Every person has to pay the tax if tax applies to their income. Moreover, taxpayers can still opt for the old tax regime if they prefer.

- Surcharge rate: The highest surcharge rate is reduced under the new income tax regime from 37% to 25%.

Income Tax Slabs For Companies/Businesses/etc

As we already talk about the income tax regime of individuals, let’s now discuss the companies and businesses for Financial Year (FY) 2023-24 under the new tax regime-

For Domestic Companies

- The standard corporate tax rate for domestic companies is 30%.

- Companies with a turnover of up to ₹400 crore in the previous year are taxed at 25%.

- New Company opts for section 115 BAB (not covered in sections 115BA and 115BAA) & is registered on/after October 1, 2019, and has started manufacturing on/before 31st March 2023 are taxed at 15%.

- Companies opt for Section 115 BAA, where the total income of a company has been calculated without claiming specified deductions, exemptions, incentives, and additional depreciation is taxed at 22%.

- The company opts for section 115BA registered on/after March 1, 2016, and is in the manufacture of any article or thing and does not claim a deduction as specified in the section are taxed at 25%.

Surcharge & Cess Charge

- For domestic companies with total income exceeding ₹1 crore but up to ₹10 crore: 7%.

- For domestic companies with a total income of more than ₹10 crore: 12%.

- Additional Health & Education Cess Rate – 4% applicable to all companies

For Partnership Firm or LLP Companies

- The standard corporate tax rate for domestic companies is 30%.

Surcharge & Cess Charge

- For companies with a total income of more than ₹10 crore: 12%.

- Additional Health & Education Cess Rate – 4% applicable to all companies

For Foreign Companies

- The standard corporate tax rate for domestic companies is 40%.

- Royalty income and fees for technical services earned by the Indian government are taxed at 10% on a gross basis

Surcharge & Cess Charge

- For foreign companies with total income exceeding ₹1 crore but up to ₹10 crore: 2%.

- For foreign companies with a total income of more than ₹10 crore: 5%.

- Additional Health & Education Cess Rate – 4% applicable to all companies